Program Policies

Program Policies

Updated January 27, 2026

The information in this document applies to the Ontario Creates funds and programs listed below. It is considered an integral part of the program guidelines and it is expected that applicants will review this document thoroughly along with the program–specific guidelines in advance of submitting an application:

- Global Market Development Program – Book, Interactive Digital Media and Film and Television

- Intellectual Property Fund – Linear and Interactive

- Publishing Marketing and Discoverability Program

- Screen Marketing and Discoverability Program

- Industry Development Program

- Enterprise Fund

CONTENTS

Definitions and General Policies

Definitions

Ontario-based – have a principal place of business* in Ontario which serves as head office and base of operations. The applicant must meet the following:

- applicant must be eligible to pay corporate income taxes in Ontario;

- Ontario address is listed as head office in T2 filing; and,

- Ontario address must be a stable and non-temporary establishment where the applicant can demonstrate that the location is under the corporation’s control and the space can be objectively identified with the corporation. For example:

- maintenance of an office for which the corporation pays rent or compensates employees

- presence of office equipment

- the place of business is listed as the corporation’s residential address in the telephone directory

- substantial quantities of the corporation’s goods are kept on the property

- residents or employees of the corporation working at the property devote all their working hours to the corporation’s interests

- substantial usage of owned/rented machinery or equipment that is used to carry out the corporation’s business

Ontario Expenditure – Ontario expenditures include goods or services provided by Ontario-based individuals or corporations in the course of carrying on their businesses at their principal place of business in Ontario.

Ontario Resident – a person who has lived in the province 200 of the last 365 days and has filed their last tax return in Ontario.

- under the employer’s direction and control;

- using the employer’s supplies/workspace/equipment/etc.;

- subject to employer’s workplace rules and discipline; and

- who issues regular compensation that includes deductions for taxes, CPP and EI

Respectful Workplace – Ontario Creates is committed to fostering respectful workplaces in all sectors and companies we support. A respectful workplace is one that values diversity and inclusion, dignity, courteous conduct, fairness, positive communication and professional working relationships. A respectful workplace is free from harassment and discrimination including sexual harassment.

The policy of Ontario Creates is to take every reasonable step to:

- Cultivate and sustain a respectful, positive, inclusive and supportive work culture

- Promote awareness of rights and responsibilities

- Prevent, identify and eliminate workplace harassment and discrimination in a timely manner

- Improve and/or restore Ontario Creates’ work environment and relationships affected by incidents or allegations of workplace harassment or discrimination, including those involving external stakeholders

Ontario Creates expects that all funding recipients maintain the principles of a respectful workplace including taking every reasonable step to:

- Cultivate and sustain a respectful, positive, inclusive and supportive work culture

- Provide a safe mechanism for staff to report incidents or allegations of inappropriate behavior

- Take action to prevent, identify and eliminate workplace harassment and discrimination in a timely manner

Diversity – Ontario Creates values and supports diversity and gender parity at all levels and business roles within creative industries. We acknowledge that many communities continue to face systemic barriers, preventing them from participating meaningfully in these industries. Ontario Creates applies a lens of diversity, equity, and inclusion to the evaluation criteria for this program, and directs jury members to do the same. Applicants proposing projects/activities that support, reflect, and strengthen diversity and gender parity in Ontario are expected to tangibly demonstrate a genuine and sustained commitment to these equity-deserving communities*. Ontario Creates encourages applications from companies that are led by BIPOC (Black, Indigenous, or People of Colour) or Francophone individuals and applicants that otherwise meaningfully meet the provincial definition of diversity**.

Program applicants are encouraged to respect the guiding principles and best practices set out in the On-Screen Protocols & Pathways Media Production Guide, Being Seen: Directive for Creating Authentic and Inclusive Content, Reelworld #HerFrameMatters Research Study and Protocol Guideline and Disability Screen Office Industry Resource Hub.

* Equity-deserving communities are those that face significant collective challenges in participating in society. This marginalization may be caused by, but not limited to, attitudinal, historic, social and environmental barriers based on age, ethnicity, disability, economic status, gender, nationality, race, sexual orientation and transgender status. Equity-deserving communities identify barriers to equal access, opportunities and resources due to disadvantage and discrimination and actively seek social justice and reparation.

** The provincial definition of diversity states: the dimensions of diversity includes, but is not limited to the following dimensions: ancestry, culture, ethnicity, gender identity, gender expression, language, physical and intellectual ability, race, religion (creed), sex, sexual orientation and socio-economic status.

Accessibility – Ontario Creates welcomes applications from people with disabilities, people who are Deaf, and people who face barriers in accessing technology to complete an application. Applicants that have accessibility needs, face accessibility barriers, or require accommodations may request an alternative process or format for submitting an application, or funds (up to $500 per application) towards service providers to assist with your application. Support for application assistance is also available to First Nations, Inuit or Métis applicants facing language, geographic and/or cultural barriers. Services may include, but are not limited to, assistance to create an account and navigate the Online Application Portal; transcribe/edit/organize/translate application materials; complete and submit application materials. Please contact the relevant Program Consultant listed in the program-specific guidelines a minimum of four weeks before the deadline.

Ontario Creates encourages applicants who host event-based activities to choose accessible venues and offer reasonable and meaningful accommodations for people with disabilities to participate in these activities. More information on the Accessibility for Ontarians with Disabilities Act can be found here https://www.ontario.ca/laws/statute/05a11.

Sustainability – Ontario Creates encourages all Applicants to implement environmentally-sustainable practices and cleaner technologies – and reduce the use of unsustainable resources – in the development, production and exploitation of their Projects.

For Screen Producers: Ontario Green Screen, led by Ontario Creates is your one stop resource to help implement sustainable practices into your projects. OGS provides free facilitated and self-directed Climate & Sustainable Production training, and Carbon Calculator training for the albert and PGA calculation tool. They also offer a wide variety of tools and resources including green vendors resource list, grid-tie in map, food donation programs, and handy best practices resource sheets to help make the transition to a green industry. Visit www.ontariogreenscreen.ca to find out more.

For general inquiries about how OGS can help support you, reach out to OGSinfo@ontariocreates.ca

Use of AI Technology – Applicants using AI technology should refer to the Ontario Government’s Responsible Use of Artificial Intelligence Directive. Ontario Creates supports the following six principles for the ethical use of AI:

- Transparent and Explainable – transparent use and responsible disclosure around data enhancing technology like AI.

- Good and Fair – respects the rule of law, human rights, civil liberties, and democratic values. This includes dignity, autonomy, privacy, data protection, non-discrimination, equality and fairness.

- Safe – must function in a safe and secure way, and ensure tools are working as intended.

- Accountable and Responsible - Human accountability and decision making over AI systems within an organization needs to be clearly identified, appropriately distributed and actively maintained throughout the system’s life cycle. An organizational culture around shared ethical responsibilities over the system must also be promoted.

- Human-centric - AI systems should be designed with a clearly articulated public benefit that considers those who interact with the system and those who are affected by it. These groups should be meaningfully engaged throughout the system’s life cycle, to inform development and enhance operations.

- Sensible and Appropriate - Data enhanced technologies should be designed with consideration of how they may apply to a particular sector along with awareness of the broader context. This context could include relevant social or discriminatory impacts.

Program juries will be instructed to refer to this framework when reviewing projects including AI elements.

The use of AI technology must be disclosed and outlined in your application. This applies to (1) the use of AI to prepare content for the application form and supporting documents and (2) submitted projects that involve the use of AI technology in the creation of content or otherwise. It is the responsibility of the applicant to ensure that all applications and projects have access to all underlying rights including content that is created with the assistance of AI technology. Ontario Creates reserves the right to require a legal opinion confirming compliance.

Application Submission

Online Application Portal – All applications must be submitted electronically through the Online Application Portal (OAP) at https://apply.ontariocreates.ca/.

Applicants that do not have a user account on OAP, should go to https://apply.ontariocreates.ca/ and click on “Register”. For assistance, please see Ontario Creates’ website for the “OAP Quick Start Guide”.

Applicants that are already registered will see the relevant Ontario Creates program deadline in their dashboard. To start the application, click on “Start New Application” and follow the directions to access the application form. For technical assistance, please contact the OAP Helpdesk at applyhelp@ontariocreates.ca.

Incorporation – Unless otherwise specified in program guidelines, applicants must be incorporated at time of application.

Financial Statements – Ontario Creates requires applicants to provide financial statements to fulfill standard Ontario Government risk assessment parameters for the delivery of transfer payments. Financial statements are reviewed internally only and reviews contribute to the evaluation of the feasibility of the proposed project and the overall track record of the company. In some cases, financial statements are also used to verify company eligibility for stated program funding tiers.

Two sets of Financial Statements must be submitted with your application: one set for the most recently completed fiscal year, and one set for the fiscal year immediately prior:

- A minimum of compilation engagement report will be accepted for projects requesting $400,000 or less. Compilation engagement report financial statements must be prepared and signed by an accountant who is a member in good standing of a provincial branch of the Chartered Professional Accountants (CPA).

- Review engagement or audited financial statements are required for requests of more than $400,000, and must be conducted by an independent public accountant who is a member in good standing of a provincial branch of the Chartered Professional Accountants (CPA).

- Financial statements are not required for requests of $15,000 or less. Exceptions may apply for requests of up to $20,000 in the Futures Forward program stream, please see program guidelines for details.

Applicants must provide financial statements as part of their application for the two most recently completed* fiscal year ends. Exceptions may be considered for companies with less than two years of operation. Exceptions will also be considered for feature film producers for fiscal year-ends 2024 and earlier, as this is a new requirement for those companies as of 2025. Companies in either situation should contact Ontario Creates in advance of the deadline.

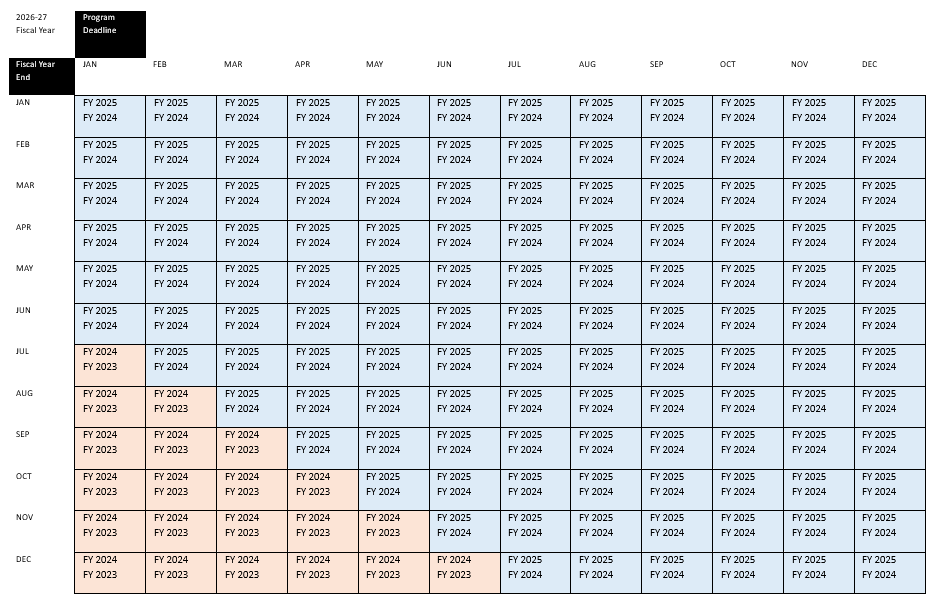

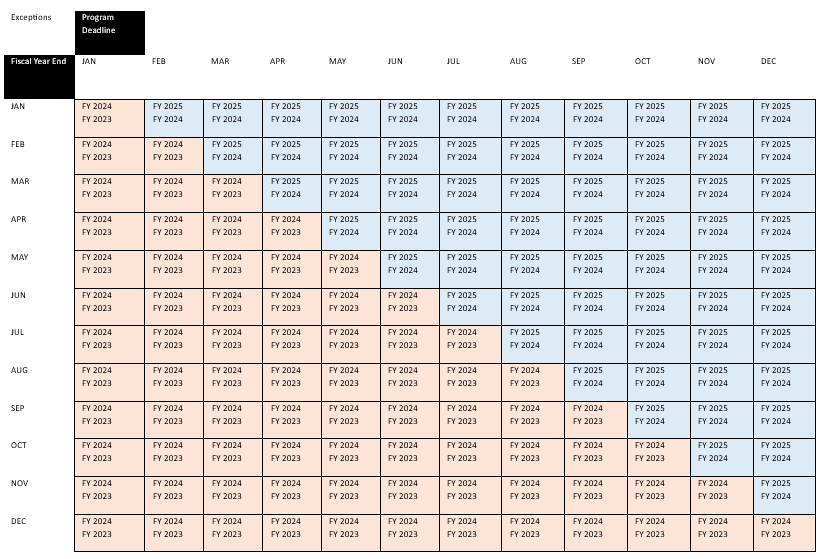

* To determine the fiscal years for which applicants must provide Financial Statements, see Appendix 1. Applicants are expected to have financial statements prepared within six months of their most recent fiscal year end. If a program deadline falls within that period, the previous two fiscal years will be accepted. Acknowledging current challenges securing financial statements within this timeline, Ontario Creates will expect applicants to have financial statements prepared within one year of their fiscal year end. This exception applies only for Ontario Creates programs in 2026-27.

Contrary to Public Policy - Products for which public financial support would in the opinion of Ontario Creates be contrary to public policy are not eligible. Products that are contrary to public policy may include products which are capable of inciting hatred against an identifiable group, including a section of the public distinguished by colour, race, religion, sex, sexual orientation or ethnic origin and products whose dominant characteristic is the undue exploitation of sex or violence, or the combination of sex and one or more of the following subjects: crime, horror, cruelty or violence.

FIPPA – Subject to the Freedom of Information and Protection of Privacy Act (FIPPA), all information contained in the application will remain strictly confidential.

Communication – Ontario Creates reserves the right to alter program guidelines with general public notice to all potential applicants and to refuse any application for any reason. All inquiries pertaining to Ontario Creates Funds are to be directed to Ontario Creates staff only.

Final Decisions – All Ontario Creates decisions are final. The number of awards and amount awarded is contingent on confirmation of Ontario Creates’ annual budget. Ontario Creates is not required to make any minimum number of awards.

Feedback – Applicants may receive feedback either via a short call on request or a group information session (program dependent) after decisions have been communicated. Feedback is provided verbally and is intended to assist with the preparation of future applications and/or ongoing activities. Evaluations are competitive and comparative for each program cycle. Incorporating feedback into a future application does not guarantee funding at a subsequent deadline.

Successful Applicants

Agreement – On acceptance into the program, the recipient company will be required to sign a standard Ontario Transfer Payment Agreement covering the terms of their participation in the program including providing Ontario Creates with permission to use the project and delivery materials for promotional purposes. A copy of this agreement is attached for review in Section 6: Appendix 2 below. Recipients may not amend the agreement template.

Accessibility – Successful applicants who are Deaf or otherwise disabled may be eligible for supplementary funds for accessibility expenses required to complete their project deliverables.

Release of Project Info – Ontario Creates is required to provide a list of funding recipients to the Ministry of Tourism and Culture and Sport and to disclose funding information on the Ontario Creates website. Information provided may include but is not limited to company, project title/description and amount of funding.

Insurance – Recipient companies will be required to carry Commercial General Liability Insurance on an occurrence basis for Third Party Bodily Injury, Personal Injury and Property Damage, to an inclusive limit of not less than $2,000,000 per occurrence, $2,000,000 products and completed operations aggregate. Ontario Creates and His Majesty the King need to be named as additional insureds on all policies. Please budget accordingly. Additional information on insurance requirements is available upon request.

Credit – Ontario Creates support is to be acknowledged with an Ontario Creates credit and logo on the project and all related publicity and promotional materials. Ontario Creates is to be advised in advance of any mention of Ontario Creates or Ontario Creates’ involvement in the project in media releases, publicity materials or social media. The Ontario Creates logo is available here: https://www.ontariocreates.ca/media-room/ontario-creates-logo

Changes to the Project – Ontario Creates must be notified of any significant changes to the project as defined in the agreement and if applicable, changes will require consent of Ontario Creates.

Interim Reports – Successful applicants will prepare written interim reports on the progress of their project.

Administrative Costs – Administrative costs (including office rent, capital costs, the cost of office supplies and other indirect expenses / excluding labour) are capped at 15% of the budget.

Project Delivery

Deliverables – The agreement with Ontario Creates will outline specific deliverables including, but not limited to: a cost report, copies of the project, marketing materials and an assessment of the program. Since project-related deliverables will vary, certain delivery requirements will be negotiated on a case-by-case basis at agreement signing.

Cost Report – Cost Reports/Statements of Actual Expenses must be submitted at the Final Report stage.

- Successful applicants awarded more than $150,000 must have the Final Cost Report audited by a licensed public accountant.

- Successful applicants awarded $150,000 or less must have a duly authorized notarized affidavit attesting to the true and fair representation of the Final Cost Report/Statement of Actual Expenses.

Upon request, copies of invoices and proofs of payments must be submitted.

Audit and Review Engagement Requirements:

- The auditor must be a member in good standing with its Provincial Institute/Order or Association, have any provincial licenses required to conduct an audit in the province where the engagement will take place, and must be independent of the application corporation.

- The auditor’s report must be addressed to the party that has engaged the auditor, that is, to the directors or shareholders of the applicant corporation.

- The audit must be performed in accordance with Canadian Generally Accepted Auditing Standards.

- The cost report must be prepared in accordance with the Generally Accepted Accounting Principles (GAAP) that are published in the CPA Canada Handbook.

- The reports must include:

- A summary of all related party transactions as well as all payments made to the producer and/or related parties;

- A declaration of non-Ontario labour or services; and

- A summary of any unpaid amounts and deferrals

- The auditor conducting the audit of the Final Cost Report should ensure that they have read and understood the requirements of the relevant program's guidelines before undertaking their reports. Special attention should be paid to the expense and financing categories which have maximum allowable caps.

- The company submitting the final cost report is responsible for ensuring that the certified independent accountant who is undertaking the audit or review engagement is aware of the relevant program policies.

Appendix 1: Financial Statement Timelines

To determine the fiscal years for which you must provide Financial Statements refer to the chart below. Find the date in which your fiscal year ends along the left side and the month in which your program deadline occurs along the top. Examples:

- company fiscal year ends in March, program deadline in August, Financial Statements required for FY 2025 and FY 2024

- company fiscal year ends in December, program deadlines in April, Financial Statements required for FY 2024 and FY 2023

Standard Requirements – Financial Statements expected to be complete within six months of fiscal year end.

Exception for 2026/27 – Financial Statements expected to be complete within twelve months of fiscal year end.

Appendix 2: Agreement Template

Ontario Transfer Payment Agreement

Ontario Transfer Payment Agreement - IP Fund Interactive Pre-Production

Ontario Transfer Payment Agreement - IP Fund Interactive Production

Ontario Transfer Payment Agreement - IP Fund Linear Development

Ontario Transfer Payment Agreement - IP Fund Linear Production